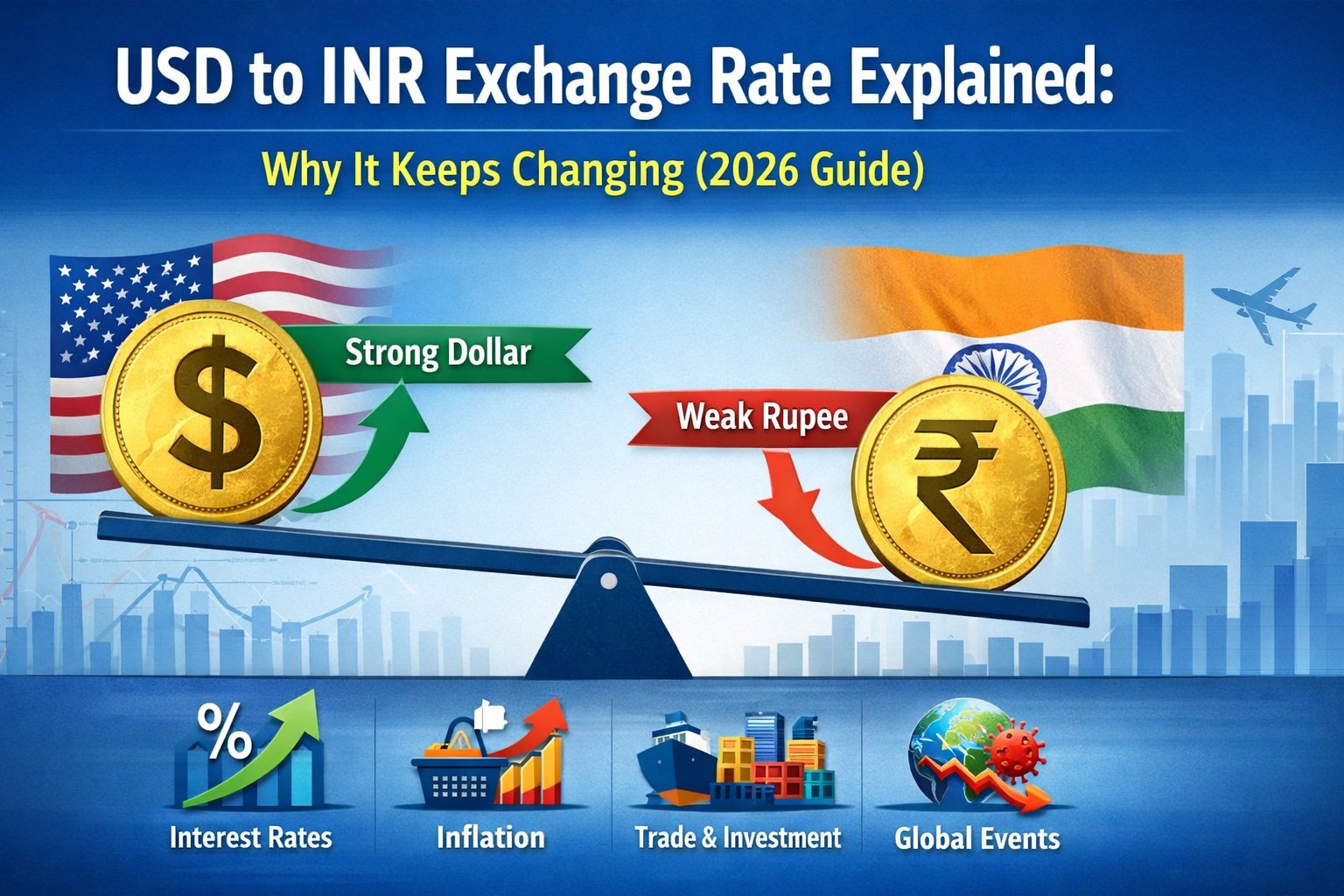

Understanding the USD to INR rate 2026 is important for travelers, students, investors, and businesses. The dollar to rupee exchange value changes daily due to global economic conditions, inflation, interest rates, and currency market demand.

Whether you are planning foreign travel, sending money abroad, paying international tuition fees, or tracking investments, knowing how the USD to INR exchange rate in 2026 works can help you plan expenses better and avoid unnecessary losses.

What Does USD to INR Exchange Rate in 2026 Mean?

The USD to INR rate 2026 shows how many Indian Rupees (INR) are required to purchase 1 US Dollar (USD).

1 Dollar Price in India (Estimated for 2026)

1 USD ≈ ₹88 – ₹92 INR

The 1 dollar price in India fluctuates daily based on forex market demand, global financial news, and policy actions.

Why Dollar to Rupee Rate Changes Daily

The USD to INR rate 2026 does not stay fixed. It changes because of the following factors:

Inflation Difference

- Higher inflation in India → Rupee weakens → Dollar price rises

- Higher inflation in the US → Dollar weakens

Interest Rates

- Higher US interest rates strengthen the dollar

- Higher Indian rates support the rupee

Trade Balance

When India imports more than it exports, demand for USD increases, pushing the dollar rate in India upward.

Foreign Investments

- FDI and FII inflows strengthen INR

- Capital outflows weaken INR

Global Events

Wars, oil price spikes, recessions, and investor sentiment can cause sudden movement in the USD–INR currency rate.

USD to INR Rate Today in 2026

To check the USD to INR rate 2026 today, use:

- Google search: USD to INR today

- Currency converter apps like XE or Investing.com

- Bank and forex websites

⚠ Bank rates may differ from live market rates due to fees and margins.

How the USD to INR Rate Affects You

Travelers

A weak rupee means higher expenses abroad. Monitoring the USD to INR rate 2026 can help travelers exchange money at better levels.

Students Studying Abroad

A stronger dollar increases tuition and living costs. Tracking the USD to INR forecast 2026 helps in financial planning.

Importers and Exporters

- Importers benefit from a lower dollar value

- Exporters gain when the dollar strengthens, making Indian goods cheaper globally

USD to INR Rate 2026 Forecast

The USD to INR rate 2026 forecast depends on:

- Inflation trends in India and the US

- Interest rate differences

- GDP growth

- Trade deficit

- Global economic stability

📊 Experts expect moderate fluctuations with occasional USD strength if US interest rates remain higher.

⚠ Currency forecasts are estimates, not guarantees.

Best Exchange Tips for USD to INR in 2026

To get the best USD to INR exchange rate:

- Compare multiple banks and forex providers

- Avoid airport exchange counters

- Use prepaid forex cards

- Track trends and exchange when rates are favorable

How Currency Exchange Works in India

The forex market determines the dollar to rupee value. Major participants include:

- Central bank

- Commercial banks

- Importers and exporters

- Investors and tourists

Higher demand for dollars raises prices, while selling pressure strengthens the rupee.

RBI’s Role in Managing Dollar Rate

The central bank helps stabilize the USD to INR rate 2026 by:

- Buying or selling dollars in the forex market

- Managing interest rates

- Maintaining foreign exchange reserves

This prevents extreme volatility in the 1 dollar price in India.

Historical USD to INR Trend

- 1970s: ~₹10 per USD

- 2000s: ~₹45 per USD

- 2020s: ~₹80–90 per USD

The long-term rise reflects inflation and economic growth, while short-term changes depend on global market conditions.

How to Convert USD to INR Online

You can convert dollars to rupees using:

- Google currency converter

- XE or Investing.com

- Bank forex calculators

⚠ Online rates may differ from cash exchange rates.

USD to INR Conversion Chart (Example)

| USD | INR (Approx.) | Usage |

|---|---|---|

| 1 | ₹90 | Small expenses |

| 10 | ₹900 | Shopping |

| 50 | ₹4,500 | Travel |

| 100 | ₹9,000 | Tuition |

| 500 | ₹45,000 | Investments |

| 1,000 | ₹90,000 | Major expenses |

Rates are indicative only.

Live USD to INR Rate Alerts

- Use Google or finance apps

- Set rate alerts

- Helps secure better exchange rates for large transactions

Conclusion

The USD to INR rate 2026 is influenced by inflation, interest rates, trade balance, and global events. By understanding how the dollar to rupee exchange works, travelers, students, and investors can plan better and reduce currency-related risks. Staying updated with live rates and trends is the smartest way to manage money in 2026.

FAQs

1. What is the price of 1 dollar in India in 2026?

Around ₹88–₹92, depending on market conditions.

2. Why does the USD to INR rate change daily?

Because of inflation, interest rates, trade balance, investments, and global events.

3. Does RBI fix the USD to INR rate?

No, it only manages volatility.

4. Will the dollar become stronger in 2026?

Moderate fluctuations are expected; global factors play a major role.

5. How can I get the best USD to INR rate in 2026?

Compare providers, use forex cards, avoid airport counters, and track live trends.

Follow Us: Facebook | Instagram

You May Also Like: